Being Broke in Old Age

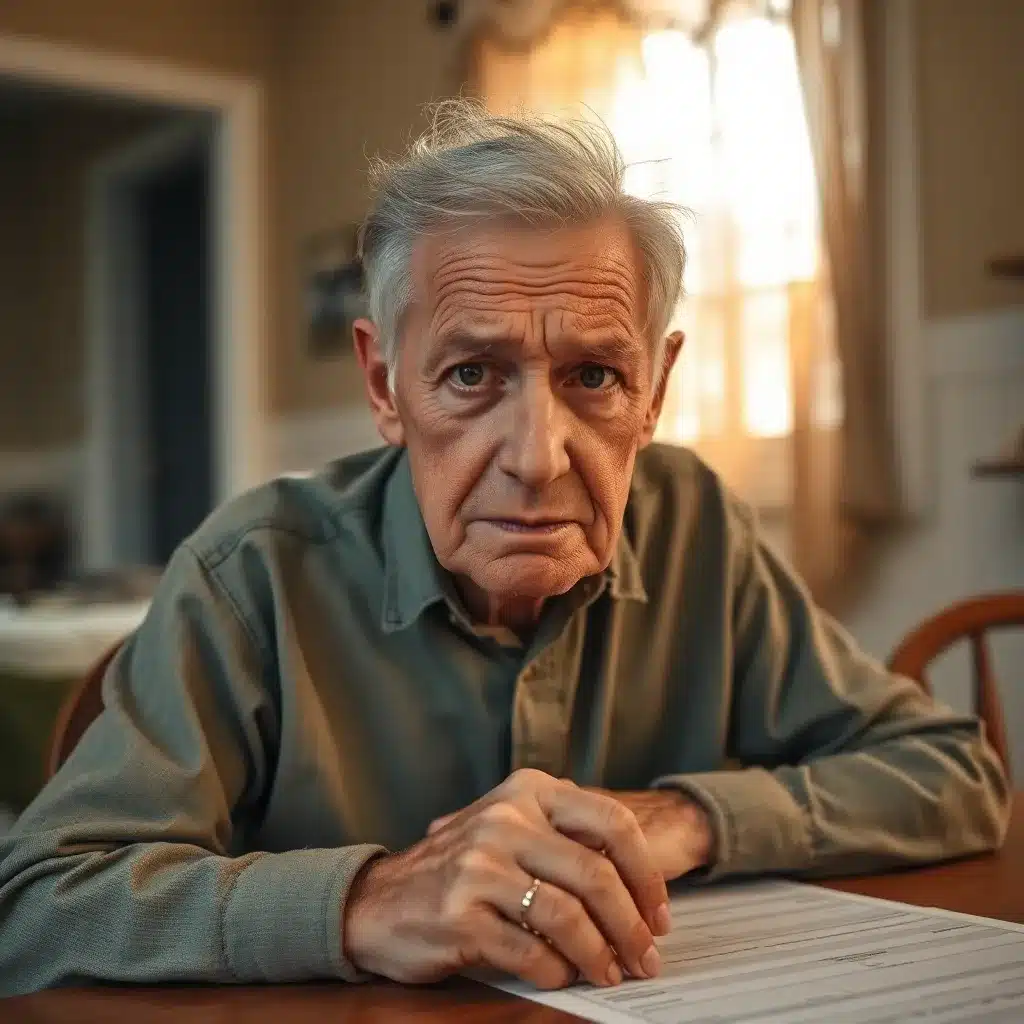

For many seniors, retiring should be a time to relax and enjoy the fruits of decades of hard work. However, for an increasing number of older adults, being broke in old age is a harsh reality. This financial insecurity, which can lead to significant stress, decreased quality of life, and a sense of helplessness, is a pressing issue.

As the cost of living continues to rise and life expectancies increase. Therefore, understanding the factors contributing to financial struggles in old age is more critical than ever. This article delves into the causes, impacts, and solutions for those facing the challenge of being broke in old age.

The Growing Crisis of Financial Instability in Old Age

So, being broke in old age is not a new issue, but it has become more prevalent in recent years. According to the National Council on Aging (NCOA), approximately 25 million Americans aged 60 and older are economically insecure.

This staggering number is a reflection of several factors, including rising living costs, the inadequacy of retirement savings, and unexpected financial emergencies that can drain savings.

Seniors are now living longer than previous generations. Many are finding that their savings aren't enough to cover the extended years of retirement. This is a common experience, and a combination of these factors is driving more seniors into poverty, making the experience of being broke in old age a widespread problem.

Causes of Being Broke in Old Age

Several factors contribute to financial struggles later in life, and while each situation is unique, common trends have emerged that highlight the underlying causes.

Inadequate Retirement Savings

One of the primary reasons many seniors find themselves broke in old age is a need for sufficient retirement savings. Many people need to pay more attention to how much they will need in their later years, leading to an uncomfortable shortfall.

According to studies, nearly half of Americans do not have enough savings to cover more than a few months of expenses, let alone the years of retirement ahead. The traditional concept of retirement—living comfortably off pensions and savings—has drastically changed. Fewer people have access to pensions, and Social Security is often not enough to cover basic living costs.

For those who worked in jobs without retirement benefits or for individuals who had to dip into their savings. Because of medical emergencies or other unexpected expenses, being broke in old age is a genuine possibility. Many seniors are forced to rely solely on Social Security, which, on average, replaces only about 40% of pre-retirement income, far less than what is needed to maintain a comfortable standard of living.

Rising Healthcare Costs

The rising cost of healthcare is another major factor contributing to being broke in old age. As people age, their healthcare needs naturally increase, often resulting in significant medical bills. Without adequate healthcare coverage, many seniors find themselves draining their savings to pay for necessary treatments, medications, and long-term care.

According to a study by Fidelity, the average couple retiring today will need approximately $315,000 to cover medical expenses in retirement. For those who lack savings or adequate insurance, these costs can lead to financial ruin.

Even with Medicare, out-of-pocket healthcare costs can be overwhelming. Long-term care, such as nursing home stays or in-home caregiving, is typically not covered, leaving seniors to foot the bill. For those already struggling financially, these healthcare expenses can quickly become insurmountable.

Social Security Shortcomings

Social Security is often the lifeline for seniors, but more is needed to keep individuals from being broke in old age. While it provides some financial support, it is designed to supplement retirement savings rather than serve as the sole source of income.

The average monthly Social Security benefit for retirees in 2023 is around $1,827, which, for many, is far below what is needed to cover housing, healthcare, and daily living expenses.

As the cost of living increases, the purchasing power of Social Security benefits diminishes, making it harder for seniors to stay afloat. Many older adults who depend solely on Social Security find themselves struggling to make ends meet, often having to choose between paying for medication or groceries.

The Impact of Economic Downturns

Unexpected economic crises, such as the 2008 financial crisis or the COVID-19 pandemic, can have a devastating impact on retirement savings. Stock market declines, layoffs and business closures can cause retirees or those close to retirement to lose substantial portions of their savings. For individuals relying on investment income, these downturns can lead to immediate financial insecurity and a sense of being broke in old age as they are left scrambling to find ways to rebuild their savings.

The Emotional and Psychological Toll of Being Broke in Old Age

The financial struggles that come with being broke in old age extend beyond just the bank account. The psychological and emotional toll can be severe. Financial insecurity often leads to feelings of helplessness, anxiety, and depression. Seniors who are unable to meet their financial obligations may feel ashamed, especially if they were once able to provide for themselves and their families.

The stress of trying to make ends meet can lead to a decline in overall health, both mental and physical. Many seniors facing these challenges report experiencing social isolation, as they may avoid activities they can no longer afford, cutting themselves off from friends, family, and social engagement. This emotional burden, coupled with financial stress, creates a vicious cycle that can be difficult to escape.

Practical Solutions for Seniors Facing Financial Hardships

While being broke in old age is a significant challenge, there are solutions available for seniors looking to regain financial stability.

Exploring Part-Time Employment

Many seniors have turned to part-time employment to supplement their income, showcasing their resilience and adaptability. The gig economy offers opportunities for flexible work, from freelance writing to ridesharing, allowing seniors to earn extra income while still maintaining a degree of flexibility. In addition, businesses are increasingly recognizing the value of older workers who bring experience and reliability to the workplace.

Downsizing and Reducing Living Expenses

One effective strategy to combat being broke in old age is to downsize and reduce living expenses. Moving to a smaller home or relocating to an area with a lower cost of living can free up much-needed resources. Many retirees also consider moving to countries where living costs are significantly lower, allowing them to stretch their savings further.

Government Assistance Programs

Government assistance programs designed to support seniors struggling financially exist. Programs like Medicaid, Supplemental Security Income (SSI), and the Supplemental Nutrition Assistance Program (SNAP) can help alleviate some of the financial burdens associated with healthcare, housing, and food insecurity. Additionally, housing assistance programs can help seniors find affordable living arrangements, reducing the stress of housing costs.

Entrepreneurship and Passive Income Opportunities

Starting a small business or generating passive income is another way for seniors to supplement their income. Affiliate marketing, blogging, or offering consulting services based on their years of experience can provide extra income with a relatively low upfront investment. These entrepreneurial ventures offer a way to stay engaged while improving financial stability.

Conclusion

But there's hope!

With the right strategies and support, you can improve your financial situation and regain a sense of control.

Practical Solutions for Financial Stability

- Create a Budget: Start by tracking your income and expenses. This will help you identify areas where you can cut back and save money.

- Explore Assistance Programs: Many local and federal programs offer financial assistance for seniors. Look into programs that provide help with housing, food, and healthcare costs.

- Consider Part-Time Work: If your health allows, consider taking on a part-time job or freelance work. This can provide extra income and keep you engaged socially.

- Downsize: If maintaining your current living situation is too costly, consider downsizing to a smaller home or apartment. This can significantly reduce your expenses.

- Seek Financial Advice: Don't hesitate to reach out to a financial advisor who specializes in retirement planning. They can help you create a plan tailored to your needs.

Finding Hope in Difficult Times

Being broke in old age can feel overwhelming, but it's essential to remember that there are solutions available.

By taking proactive steps and seeking support, you can improve your financial situation and enjoy your golden years with dignity.

Don't hesitate to reach out for help and explore the resources available to you.

You deserve a comfortable and fulfilling life, no matter your financial situation.

Being broke in old age is a growing crisis that affects millions of seniors worldwide. The combination of inadequate savings, rising healthcare costs, and economic uncertainties can leave older adults financially vulnerable during what should be their most comfortable years. However, with the right strategies—such as supplementing income, reducing expenses, and seeking out available support—seniors can navigate these financial hardships and work towards greater Security. It is never too late to take control of your financial future, even in old age.

References

- National Council on Aging (NCOA). "Economic Security for Seniors Facts." NCOA Website.

- Fidelity. "How Much Do I Need to Retire?" Fidelity.com.

- Social Security Administration. "Retirement Benefits: How Much Are You Really Receiving?" SSA.gov.

- AARP. "Managing Money in Retirement." AARP Website.