Here’s What I Should’ve Done Differently

Reflections of Early Retirement

I remember the day I signed the paperwork for my early retirement as if it were yesterday. It was a bright morning, and I walked out of my company’s building feeling a mix of triumph and relief. No more rushing through traffic or juggling endless meetings. I was finally free—free to use my time as I pleased. However, in the months following that milestone decision, I came face-to-face with the realities of retiring earlier than most. I had set aside savings and dabbled in a few investment accounts. Still, the truth is, I hadn’t fully comprehended the financial and lifestyle impacts of leaving work at a stage when many people are still building their careers.

In this blog post, I’ll share what I should’ve done differently as a senior who opted for early retirement. My story isn’t meant to discourage anyone from following this path but rather to highlight the lessons learned so you can make more informed choices. This is for you if you’re considering an early exit from the workforce.

1. Understanding the Importance of Early retirement Planning

When I first considered early retirement, it felt like an adventurous leap into a more relaxed life. The idea of leaving the daily grind behind to pursue personal projects, hobbies, and travel was undeniably tempting. However, I quickly realized that early retirement demands high planning and foresight—things I had only partially considered.

- The Allure of Free Time: The idea of endless days with no obligations is initially intoxicating. But without a clear plan for structuring your time, those days can start feeling aimless. I didn’t anticipate how much my sense of purpose was tied to my job.

- Overlooking Cash Flow: I didn’t build a robust strategy for predictable monthly income despite savings. In retirement, you lose the security of a paycheck, so your savings, investments, or pensions must cover necessities and unexpected costs.

A comprehensive retirement readiness check would have saved me from financial and emotional stress. For instance, speaking with a financial planner who specializes in early retirement could have helped me set more realistic income goals and ensured the right mix of short-term savings and long-term investments.

2. Key Financial Pitfalls

The first few months of my retirement were blissful. Then, I noticed my bank balance declining more rapidly than I expected. Why? Because I made classic mistakes many new retirees do:

- Underestimating Living Costs: It’s surprising how routine expenses include healthcare bills, property taxes, home repairs, and everyday essentials. Even simple hobbies like gardening or golfing can cost more than you think when they become a central part of your life.

- Forgetting About Inflation: Prices go up, whether it’s groceries or medical supplies. Over a decade or more in retirement, inflation can dramatically reduce your purchasing power if you’re not prepared.

- Lack of Investment Diversification: I put too much money into a single type of investment. When that sector dropped, I felt more impact than if I’d spread my investments around different industries and asset classes.

- Starting Social Security Too Early: If you opt to receive Social Security benefits as soon as possible, you might lock yourself into lower monthly checks for life. I wish I had run more scenarios about waiting a few years to maximize my benefits.

What I Should’ve Done Differently: I wish I had established a structured withdrawal plan—deciding which accounts to tap into first, how to stagger withdrawals, and reevaluating my investment strategy with a professional. Also, calculating a realistic budget that accounts for inflation would have provided a more precise financial roadmap.

3. Lifestyle Adjustments

During my working years, I took for granted how much my job shaped my daily routine. Meetings, commutes, and deadlines gave structure to my days. Once I retired, I thought I’d fill my schedule with leisurely mornings and spontaneous afternoons, but I quickly discovered that a lack of structure can lead to restlessness.

- Social and Emotional Challenges: A job isn’t just a source of income; it also provides social interactions and mental stimulation. After early retirement, I missed my colleagues and the sense of achievement that came with meeting work goals.

- Hobbies and Routines: While I had hobbies, I didn’t have enough variety to sustain long-term engagement. I recommend diversifying your interests before you retire—this could be anything from joining community groups to exploring part-time work or consulting projects.

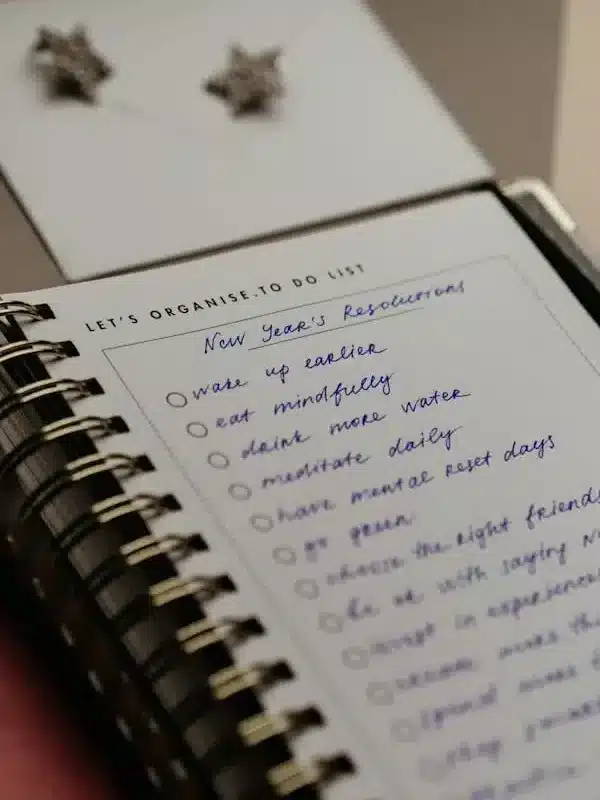

What I Should’ve Done Differently: Creating a flexible schedule or a to-do list that includes enjoyable pursuits and practical tasks helps maintain a sense of purpose. I also learned the value of planning social activities, such as weekly meet-ups with friends, volunteer work, or classes to learn new skills.

4. Health and Wellness Considerations

One aspect of early retirement planning often overlooked is healthcare. I learned this the hard way when I retired and faced higher insurance premiums because I wasn’t yet eligible for Medicare. Medical expenses can be one of retirement's most significant financial burdens, especially if you have chronic conditions or need specialized care.

- Preventative Care: The earlier you focus on diet, exercise, and routine check-ups, the better. Retirement can be an opportunity to shape a healthier lifestyle, but I didn’t prioritize health until I was forced to deal with nagging issues like joint pain and fatigue.

- Mental Health Matters: Leaving a structured work environment can also affect mental well-being. Anxiety about finances or a feeling of boredom can creep in. Seeking professional advice or engaging in mindful practices such as meditation can help.

What I Should’ve Done Differently: I wish I had explored different health insurance options before retiring—like COBRA, private insurance, or association health plans. It’s also crucial to establish a health regimen that includes exercise, regular screenings, and attention to mental health before taking the retirement leap.

5. Social Engagement and Meaningful Activities

When you retire early, your social circle can shift dramatically. Former colleagues may still be deep in their careers, while neighbors might be at different life stages. I longed for the casual banter and camaraderie that comes with office life.

- Volunteering and Community Work: Getting involved in local community projects or charities is a great way to stay connected and contribute meaningfully. I regret not starting this sooner.

- Learning Opportunities: Retiring early can free up time to learn something new. Whether picking up a language, taking cooking classes, or exploring digital skills, these pursuits can keep your mind sharp and broaden your social circle.

What I Should’ve Done Differently: Taking proactive steps to expand my social network outside of work before I retired would have cushioned the emotional transition. Joining interest-based clubs, signing up for workshops, and trying to maintain friendships would have alleviated my initial isolation.

6. What I Wish I Had Done Differently

Putting it all together, here are the key lessons I’ve taken away:

- Consult Multiple Financial Perspectives: Don’t rely on a single source or your assumptions. A financial planner, online calculators, and personal research can give you a more holistic view.

- Gradual Transition: If possible, retire by reducing work hours or going part-time. This helps you test the waters and adjust your budget and routine gradually.

- Establish a Purpose-Filled Routine: Plan your day with meaningful activities—whether volunteering, pursuing creative projects, or caring for grandchildren. This purpose helps combat feelings of aimlessness.

- Prioritize Health: Secure a healthcare plan, focus on preventative care, and address mental well-being. The earlier you do this, the smoother your retirement years will be.

- Nurture Social Ties: Stay connected. Schedule meet-ups with friends, join community groups and maintain relationships that help you feel valued and engaged.

Conclusion

Early retirement can be a liberating, exciting chapter in life, but it’s not without its pitfalls. If I could turn back the clock, I would have sought professional financial advice, diversified my social network, and paid more attention to my long-term health requirements before taking the plunge. Yet, even with these missteps, I’ve found a path to fulfillment by reassessing my priorities, seeking new ways to engage socially, and rethinking my financial approach.

If you’re considering early retirement, let my experiences be a guide. With solid planning, ongoing adjustments, and a keen awareness of your personal goals, creating a retirement that meets your needs and enriches your life in ways you never thought possible is possible. Take the time to prepare, make informed decisions, and remember that the journey to a fulfilling early retirement is ongoing—learn from those who have gone before you. You’ll stand a better chance of enjoying all the freedoms this next stage can offer.

Thank you for reading! I hope my reflections on what I should’ve done differently in early retirement help you plan effectively for your journey.

Comments are closed!