Growing Disparities in Retirement

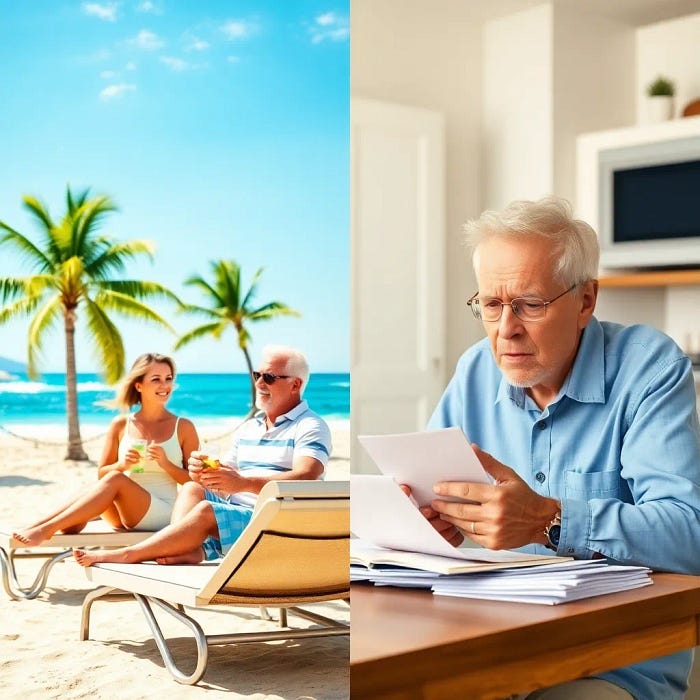

As the workforce ages and more Americans approach retirement, the topic of financial security has never been more pressing. Yet, amidst rising concerns about retirement savings. A troubling trend has emerged: the growing disparities in retirement savings among different income groups.

These disparities are not just numbers; they are shaping the retirement landscape. With some households successfully accumulating wealth for their golden years while many low- and moderate-income families are left with little to no retirement savings.

This article will explore the factors contributing to these disparities and emphasize the importance of addressing this issue for a more equitable retirement landscape.

Bridging the Gap: Understanding the Growing Disparities in Retirement Savings

In recent years, the responsibility for securing a comfortable retirement has increasingly fallen on the shoulders of individual workers, mainly through vehicles like 401(k) accounts. However, significant disparities in retirement savings between low- and high-income households have become more pronounced, raising concerns about financial equity and long-term security.

The Current Landscape

According to recent studies, the number of low-income households (ages 51–64) with retirement account balances has drastically decreased. This trend existed even before the economic disruptions caused by the COVID-19 pandemic. As workers navigate this challenging landscape, it’s crucial to understand the key factors contributing to the widening gap in retirement savings.

Key Factors Influencing Retirement Savings

Income Disparities:

It’s no surprise that higher-income households save more for retirement. Research shows that high-income families typically save around 8% of their income, while low-income households manage to save only about 5%. Furthermore, employer contributions play a significant role, with high-income households receiving an average of $5,000 in donations compared to just $1,300 for low-income families.

Family Dynamics:

The presence of children in a household can also impact retirement savings. Households with two children often have retirement account balances that are approximately 40% smaller than those without children. This can be attributed to the high costs associated with raising children, which can hinder a family’s ability to set aside money for retirement,

Educational Attainment:

Educational achievement significantly correlates with growing disparities in retirement. Households led by individuals without a college degree tend to have retirement account balances that are 63% smaller than those led by college-educated individuals. Education often leads to better job stability and higher earnings, contributing to more substantial retirement savings.

Employment Stability:

Low-income workers are more likely to experience job disruptions, which negatively impacts their ability to save. In 2019, only 23% of low-income households had access to an employer-sponsored retirement account, compared to 75% of high-income households. This lack of access forces many low-income workers to take proactive measures to open individual retirement accounts (IRAs), which often come with higher fees and lower returns.

Racial Disparities:

Racial inequalities in retirement savings mirror broader income disparities. In 2019, about 63% of White households had retirement account balances, compared to only 41% of families from other racial backgrounds. Moreover, White households typically held median balances that were nearly double those of different racial groups.

The Path Forward

Addressing these disparities is crucial for ensuring that all workers, regardless of income level, have the opportunity for a secure retirement. Solutions include:

- Expanding access to employer-sponsored retirement plans.

- Increasing education around retirement savings.

- Implementing policies that support lower-income families in building their retirement nest eggs.

By understanding the factors that contribute to the growing disparities in retirement savings, we can begin to advocate for changes that promote financial equity and security for all workers. As we move forward, it’s essential to create a retirement landscape that not only supports high-income earners but also uplifts those who are often left behind.

Finding alternatives like internet marketing can be a valuable strategy for retirees facing financial challenges, especially in light of reduced funds and the growing disparities in retirement savings.

Here’s how internet marketing can help:

Creating Passive Income Streams

Internet marketing offers retirees the opportunity to generate passive income through affiliate marketing, digital products, or online courses. This can be especially beneficial for those who may need more substantial retirement savings. By promoting products or services they believe in, retirees can earn commissions or royalties without requiring a significant upfront investment.

- Source: The idea of generating passive income is supported by various financial experts, emphasizing that leveraging online platforms can create sustainable income sources. For instance, the Pew Charitable Trusts outlines how more Americans are turning to alternative income strategies, including online ventures, to secure their financial futures.

Flexible Work Opportunities

Internet marketing allows for flexible working hours and locations. Retirees can work from the comfort of their homes, tailoring their schedules to fit their lifestyles. This flexibility can help retirees manage their time while still contributing financially, reducing stress associated with traditional job structures.

- Source: Reports from AARP indicate that many retirees are seeking flexible job opportunities that can accommodate their desired lifestyle changes, with online marketing being a prime option(

Low Startup Costs

Many internet marketing strategies, such as blogging or social media marketing, require minimal startup costs. Retirees can leverage their existing knowledge and skills to start a blog or create an online course without the need for significant financial investment. This is especially important for those with limited retirement savings.

- Source: Various guides discussing online entrepreneurship echo the potential for low-cost entry into online business models, highlighting the affordability of digital marketing ventures compared to traditional businesses.

Building a Personal Brand

Retirees can use internet marketing to build their brand, sharing their expertise or hobbies with a broader audience. This can not only lead to monetization opportunities but also foster a sense of purpose and community engagement.

- Source: Articles from Northwestern Mutual and other financial advisors stress the importance of personal branding and online presence in today’s economy, showing how retirees can leverage their knowledge to connect with others while earning money.

Access to a Global Market

The Internet provides access to a global audience, allowing retirees to market products or services beyond their local communities. This expanded reach can lead to increased sales and more excellent financial stability.

- Source: Market research reports highlight the advantages of Internet marketing for reaching diverse demographics, emphasizing the potential for retirees to tap into global markets for greater profitability.

In summary, finding alternatives like internet marketing can significantly aid retirees facing financial challenges. By providing flexible, low-cost, and scalable opportunities, internet marketing empowers seniors to enhance their income, achieve economic stability, and maintain a sense of purpose in retirement. As traditional retirement funds may no longer suffice, embracing online entrepreneurship can be a crucial strategy for navigating the growing disparities in retirement savings.

Conclusion

The growing disparities in retirement savings highlight a significant challenge facing our society today. As we continue to navigate an increasingly complex financial landscape, we must prioritize solutions that ensure all Americans can secure their financial futures. By addressing the underlying factors contributing to these disparities — such as income inequality, access to retirement plans, and educational attainment — we can work towards a more equitable retirement system that benefits everyone.

As advocates for change, we must push for policies and programs that support high-income earners and uplift those who are often left behind. The future of retirement depends on our ability to create a system that works for all, ensuring that every American can enjoy a secure and fulfilling retirement.

References

AARP — Retirement Savings Disparities: This article discusses the differences in retirement savings between various demographics, emphasizing the struggles faced by low-income and minority households. It highlights the access challenges and the importance of expanding retirement options.

This report from Pew Charitable Trusts outlines the retirement savings crisis in the U.S., focusing on the number of Americans who are unprepared for retirement. It underscores the need for policy changes to address these disparities and inspire a more equitable retirement system.

Politico — Wealth Inequality in Retirement: This article discusses legislative changes affecting retirement plans and how they disproportionately benefit high-income earners, exacerbating wealth inequality in retirement savings.

Finch — Key Retirement Trends: This article outlines emerging trends in the retirement sector, addressing how changes in legislation and access to retirement plans affect different income groups.

Northwestern Mutual — Retirement Planning: This survey highlights the financial challenges many Americans face when planning for retirement and sheds light on the average savings of different demographics.

Empowering Seniors in the Digital World!

Join our community where experience meets innovation — sharing resources, tips, and inspiration for senior entrepreneurs ready to make their mark.